Originally published in The Tennessean, July 2023

Many of us pay premiums to a health insurer, whether that’s through our employer or an individual plan. A big part of what we pay for is peace of mind. We can rest easier knowing that should we experience a health event, be it a routine exam or a medical emergency, we’re covered thanks to what we all paid in together.

Peace of mind also comes from knowing our insurer has used our dollars responsibly, reducing our health care costs in the process, and is always looking ahead to help ensure these costs stay low.

Many companies work to maximize their profits, building in the highest margins possible. But BlueCross is in a unique position as a tax-paying, not-for-profit company. We’re focused on serving Tennesseans’ health care needs.

A look back — and forward

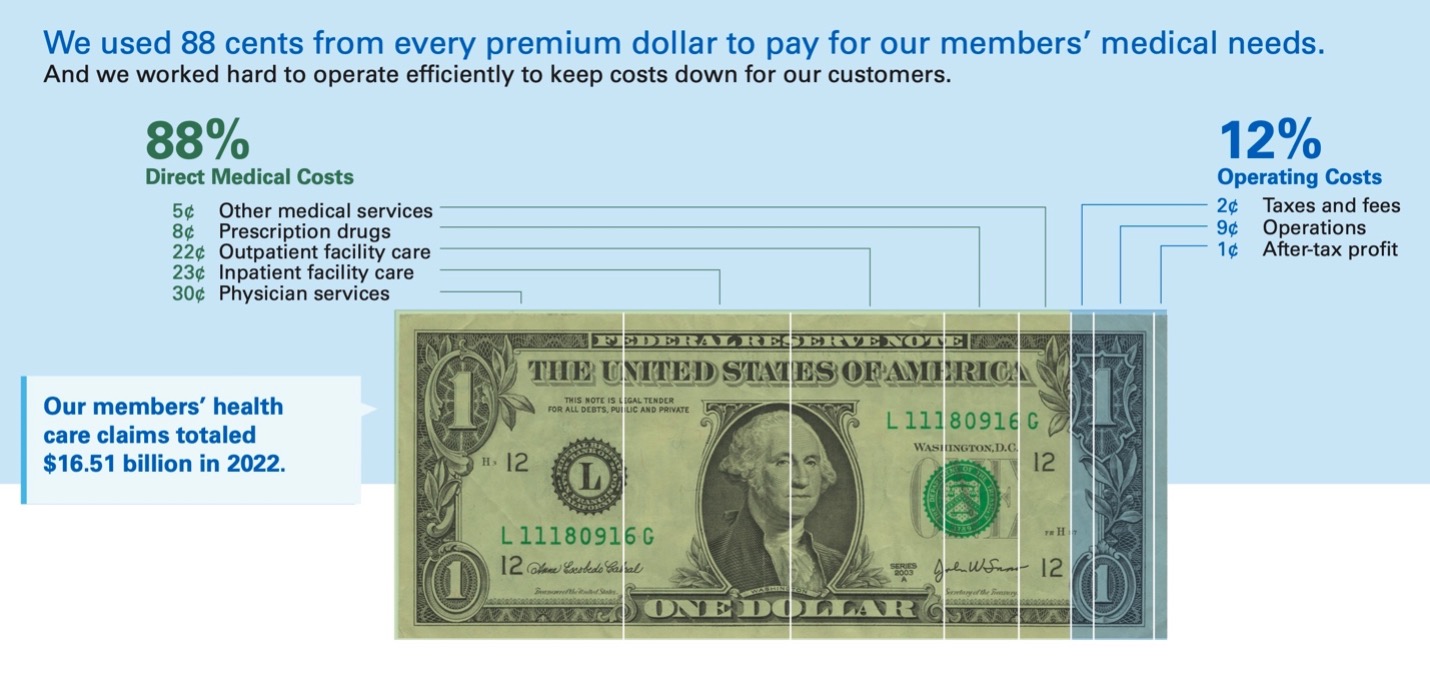

In 2022, we paid a near-record $16.51 billion in claims, and we used 88 cents from every premium dollar to pay for our 3.3 million members’ medical care. Paying those claims is our role, but we also have a responsibility to listen to customers (many of whom are Tennessee businesses), lower their costs and be good stewards of our members’ premium dollars. And we understand that lower profit margins are vital for meeting this need.

But like any organization, we have to cover our operating costs and plan for some profit to be sustainable.

Last year, we earned $22 million in after-tax net income, which represents 0.1% of our gross revenues. That amounts to us keeping just a dime from every $100 we collected in premiums.

Now, we’re already looking ahead to 2024 and determining our pricing based on what we’re expecting to pay out on behalf of our members. That starts by looking at this year’s medical claims trends and provider rates, along with what we paid in taxes and our operating costs.

The two fundamental drivers of insurance costs are the medical services people need and what providers charge to administer these services. When hospitals, doctors and prescription drug companies charge more, employers and members like you have to pay more for health coverage.

Right now we’re finalizing 2024 rates for our Affordable Care Act Marketplace plans, which people can enroll in directly this fall. But our lowest-price possible approach applies all of our lines of business. Whether it’s Tennessee employers purchasing health care plans for their people or self-funded groups who pay their own claims but pay BlueCross fees for managing the provider networks and benefits plans, our job is to be as efficient as possible.

Untangling cost complexity

Health care cost management is a complex problem, and tackling it requires multiple solutions.

- We’ve revamped our eight Blue of Tennessee centers, making it more convenient for members to get high-quality care and help from an insurance advisor all in one location.

- We’ve latched onto convenience as a driver of health care decisions and expanded access to primary and behavioral health care through our virtual care services.

- And we’ve negotiated lower costs for prescription drugs through our specialty pharmacy program.

The widely held consensus is that health care costs will continue to rise. There’s a reason for this: Potentially lifesaving options require years of research and development.

At BlueCross, we’re in the business of helping make people healthier. That’s why we’ve built lower margins into our pricing, knowing our mission comes first.

But it’s incumbent on all businesses to think past the bottom line. We all must invest in ways that serve our customers’ well-being.

Dalya leads a team responsible for marketing, communication and community relations strategies that reflect the mission-driven culture of BlueCross. She has more than a decade's experience as a communications leader in health care, government services and sports information.

Dalya leads a team responsible for marketing, communication and community relations strategies that reflect the mission-driven culture of BlueCross. She has more than a decade's experience as a communications leader in health care, government services and sports information.